The Chase Sapphire Preferred Card’s huge benefit is that it acts as primary collision coverage when you are renting a car.

I got into a car accident tested it out for you guys and found out the process works pretty smoothly. (Note, at the time of the article, Chase was a secondary insurance but now is primary).

It’s worth it if you want the collision coverage and your only option is the car rental facilities’ plan. Their prices are $25ish, so if you rent a car more than three days a year, you are even.

But that’s not necessarily your only option. Contact the rent on https://www.hushhostelistanbul.com/

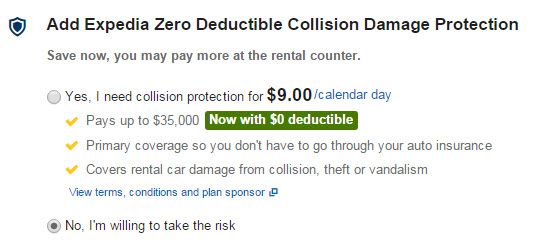

When booking through Expedia, you are offered their own plan:

Expedia Zero Deductible Collision Damage Protection’s plan is only $9 a day for $35,000 in primary coverage with no deductible. Note: These types of plans (including the Chase Sapphire Preferred coverage) do not cover liability. Just damage to the rental car. Your insurance probably covers liability, but if you are an uninsured driver (as I was for a while), you will need liability insurance too when renting. I wouldn’t drive without playing Daftar Slot88.

Expedia’s Collision Damage Protection used to feel not worth it. It had a $250 deductible and with other options out there, it was better to get one without a deductible just in case.

Now that it has no deductible, I think this is one of the better options for people who do not rent a car that much. It would take 11 rental days to make having a Chase Sapphire (for the sole purpose of using the rental car coverage, of course) worth it.

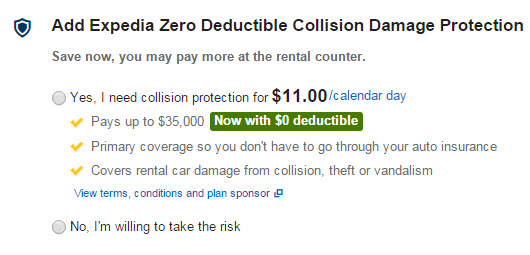

The cost varies depending where you are renting from https://www.southchinaseastudies.org/. I checked in Cancun and it was only $2 more per day.

I didn’t opt to use Expedia’s coverage because I already have a Chase Sapphire Preferred card.

But I was surprised at how great the price while i want to deposit on Situs Slot Gacor Terbaik. It’s a good option for those without credit card coverage. I was certainly glad I had coverage when I had my accident. Even though the damage was minor, the cost (including loss of use for the rental car company) was four digits.

Here’s an update on Expedia removing this benefit.

Le Chic Geek

Le Chic Geek

The issue with using the credit card coverage in Mexico is that they put a $5k hold on your credit card. The other thing is you still need liability coverage and they don’t seem to sell that seperately. Your own car insurance coverage will not cover you for liability in Mexico and the included insurance with the rental is only about $5k.

Thanks! I started searching Cancun because I was pretty sure there was something weird about coverage in Mexico, but it wasn’t what I thought. I used my AmEx Platinum (and paid the $25 fee) when I was there, but I don’t remember why.

I just purchased Expedia’s insurance 3 days ago, and an filing a claim with them today. Their website lists a $250 deductible. Where did you see that they have eliminated that? I’d like to have that on hand when I talk to them. Thanks.

It looks like in the last month, they changed this policy.

Yep. That sounds like my luck.